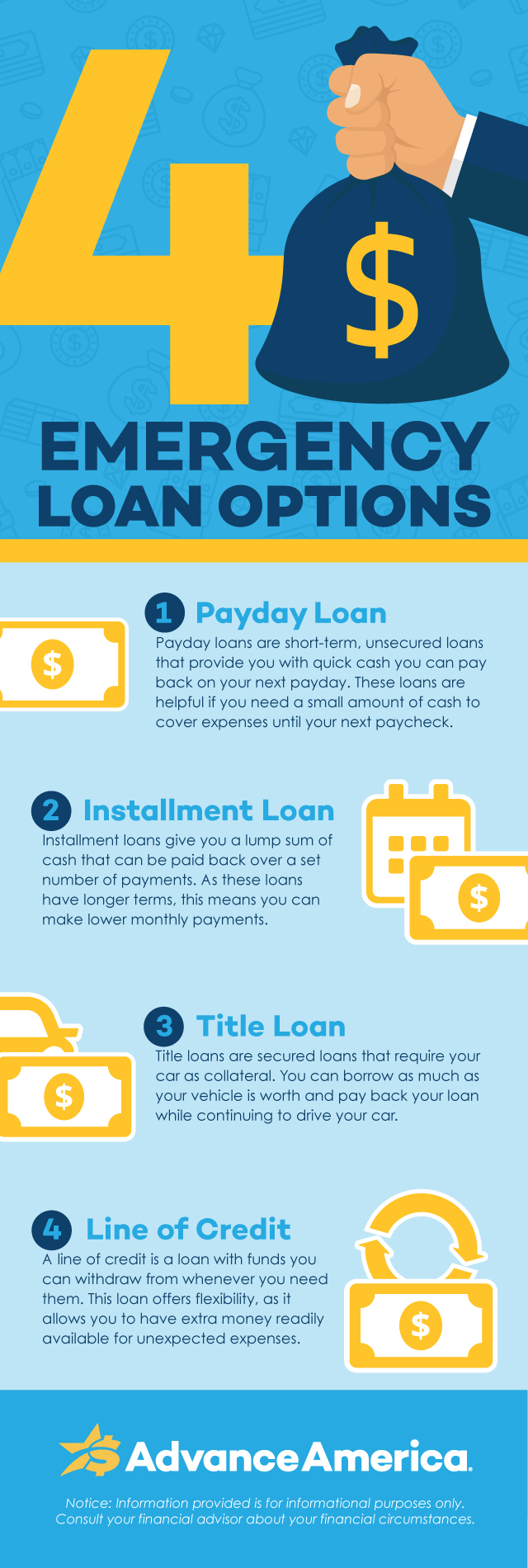

Emergency Loans are funds that you can receive when you need to cover unexpected expenses, like a medical bill or a car repair. There are many types of loans that you can get quickly when you find yourself in an unforeseen financial situation, such as Payday Loans, Installment Loans, and Title Loans. Learn more about the types and benefits of Emergency Loans to decide which loan can best help you cover your costs. Already have an account? Login.