How Do Advance America Title Loans Work?

Your Car Is The Key To The Cash You Need

What is a title loan?

Title loans are secured loans that let you use your vehicle as collateral. The amount of money you can receive from this type of loan can vary depending on how much your car is worth. Title loans are short-term loans, and in many cases, you’ll repay the lender in a lump sum payment. Your lender will typically hold onto your car title until you repay the loan, but you can continue driving your vehicle.

How do Title Loans work?

A Title Loan allows you the ability to receive a larger loan amount, using your vehicle as collateral. Simply bring your car to your nearest Advance America center for evaluation, and one of our employees will perform an inspection to determine its value. The loan amount you receive is dependent upon the value of the vehicle. If your title application is approved, you will walk away with cash in hand*.

Benefits of title loans

Here are some benefits of getting a title loan:

Easy application process

The application process for a title loan is usually quick and easy, and will only take a few minutes to complete. Once you bring your car to an Advance America store location, your car will get a quick inspection and then you can sign the loan paperwork.

Quick approval

Once you get your car appraised and fill out all necessary paperwork, you may get an approval decision very quickly. If approved for an Advance America title loan, you can receive the funds that same day.

You don’t need good credit

Since a title loan is a secured loan, you don’t need good credit to get approved. Many lenders have few or no requirements when it comes to your credit score. You can get approved for an Advance America title loan with poor or fair credit.

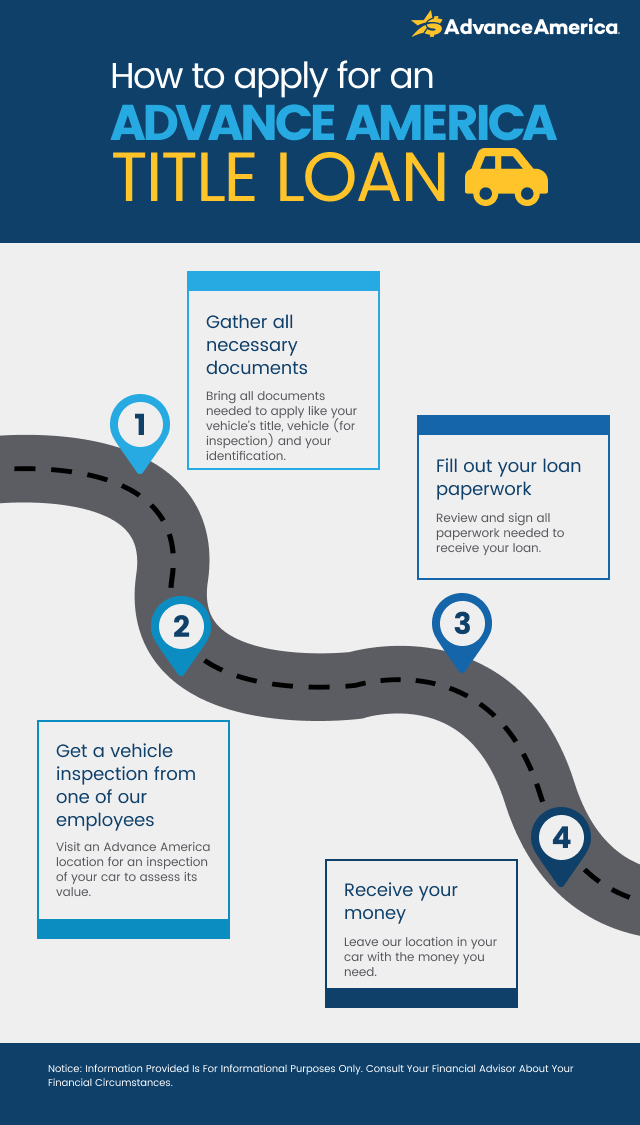

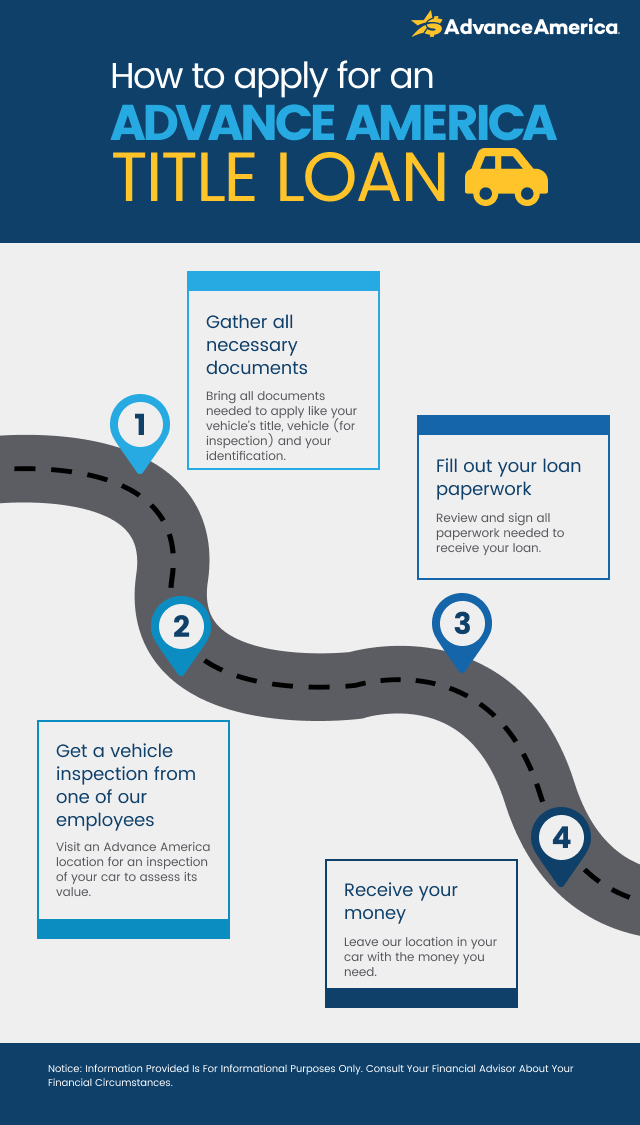

How to apply for a car title loan

Before applying for a Title Loan, contact your local Advance America location or enter your zip code or city, state above to see if Title Loans are available in your area.

- Grab your vehicle’s title along with your identification. In some states proof of residency (utility bill), proof of income and vehicle insurance may be required

- Drive your car to one of our centers

- Allow one of our employees to perform an inspection on your vehicle in order to determine its value

- Fill out and sign your loan paperwork

- Leave our location in your vehicle with your cash in hand*

Can title loans affect my credit score?

Generally, a title loan won’t affect your credit score, which can be a pro or a con, depending on your scenario. Title lenders don’t typically run a hard credit inquiry, which can knock off about five points from your credit score, when you apply. But title lenders also don’t typically report payments to the credit bureaus, so you’re not getting a credit boost that way.

How much can I borrow with a title loan?

According to the Federal Trade Commission, title loans typically range from $100 to $5,500. But some lenders allow you to borrow $10,000 or more, depending on the assessed value of the vehicle.

Source: https://www.consumer.ftc.gov/articles/0514-car-title-loans

Comparing title loans vs. other loan options

Title loans are short-term loans based on the value of your vehicle, which acts as secured collateral. Here are other loan options to consider:

- Installment loan: With an Installment Loan, you can borrow money that you need, and it typically comes with a fixed term and fixed interest rate to make your monthly payments consistent.

- Payday loan: Payday loans are for small amounts and short terms, usually about two to four weeks, lining up with your next scheduled payday. Instead of using your vehicle as collateral, you secure this type of loan by giving the lender access to debit your bank account or by writing a postdated check.