How to Get a Loan with No Credit | Loans for No Credit History

If you don’t have an established credit history, you can still get a loan for no credit. There are lenders who will look at factors in addition to your credit score when deciding whether to approve you. Let’s dive deeper into how to get a loan with no credit history.

What is credit history?

Your credit history is all information regarding your payment history, types of credit accounts and how long you’ve had them, the debts you owe, and the number of recent credit inquiries. Credit history, which is recorded in your credit report, can show lenders how likely you’ll repay a loan and how risky of a borrower you are when they review your loan application.

What factors affect your credit?

Here are some common factors that affect your credit score:

- Payment history

- Amounts owed

- Credit history length

- Credit mix

- New credit

Visit our credit score page to learn more about these factors.

How getting a loan with no credit works

To get a loan with no credit history, you’ll need to find a lender who will consider more than just your credit score. A lender is more likely to lend you money if they also check your employment history, income, debt, and other factors in addition to your credit.

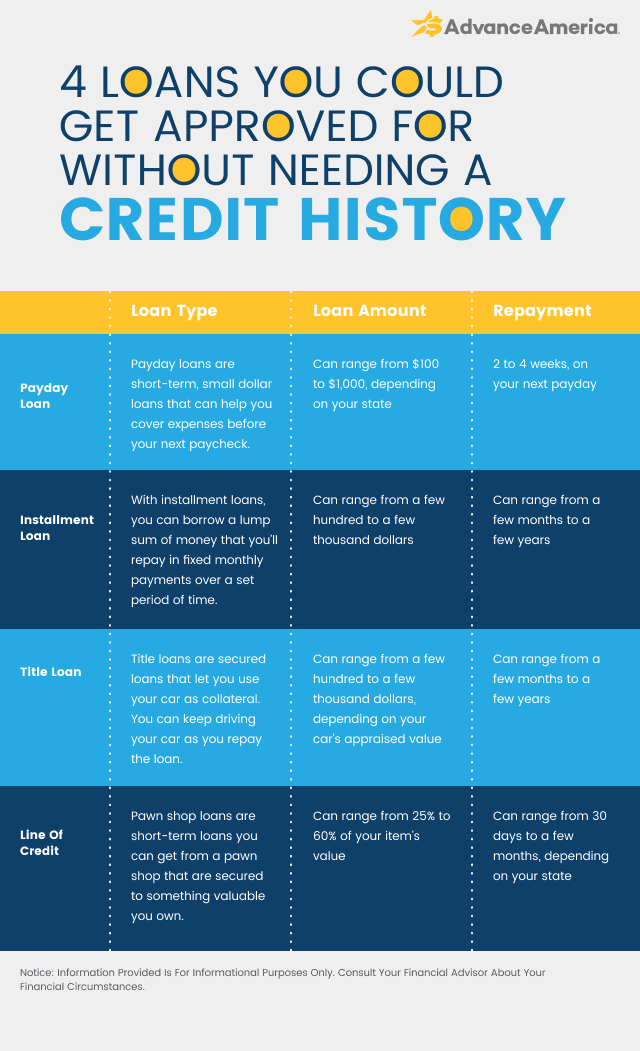

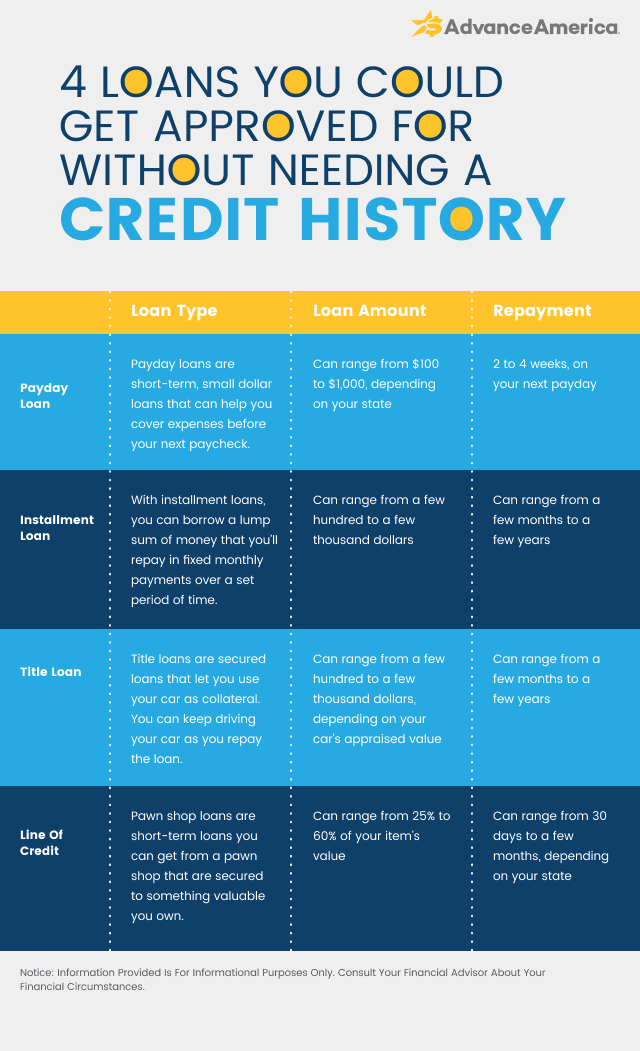

Types of loans for no credit history

If you’re interested in loans that you may get approved for without an established credit history, here are some of your options:

Payday loans

Payday loans are short-term, small dollar loans that can help you cover immediate expenses until your next payday. You can pay these loans for no credit back once you get your paycheck, typically within two to four weeks.

Installment loans

Installment loans allow you to borrow a lump sum of money at once. In many cases, you’ll pay this loan for no credit back via fixed monthly payments over an agreed upon time period or term.

Title loans

Title loans are secured loans that use your car as collateral. As long as you own your car, you can exchange your title for cash. You’ll be able to continue driving your car as you pay your loan for no credit back on time.

Pawn shop loans

Pawn shop loans are short-term loans that are secured to something valuable you own. The loan amount you can receive will likely be anywhere from 25% to 60 of the value of your item.

Benefits of getting a loan with no credit

Here are some advantages of getting a loan with no credit:

Easy application

You can fill out an application for a loan with no credit history in just a few minutes, in store or online from the comfort of home. You’ll just need to provide a few personal and financial details, like your name, address, and bank account number.

Quick approval

Many lenders offer an instant or quick approval decision for loans for no credit. This means you may find out whether you’re approved within a few minutes. If approved for a loan with no credit, you may receive the funds the same day you apply or within 24 hours.

No credit needed

You don’t need an established credit history to get approved for a loan. Many lenders have less strict credit score requirements and will consider factors in addition to credit score, like income and employment history, when deciding whether to approve you.

How to get a loan with no credit history

To apply for a loan with no credit history, follow these steps:

1. Research lenders

Make sure to do your research on lenders before applying for a loan for no credit. You could search the internet to find some loan options and compare the pros and cons of each.

2. Choose a loan option for no credit

Once you find a loan for no credit from a lender you like, make sure you fully understand it, including its rate, term, and fees. If you have any questions, ask the lender for clarity.

3. Fill out your application for a loan with no credit

Fill out the application form for a loan with no credit and provide basic details like your name and address as well as information about your employment and income. Double check the application before you submit it to make sure all information is correct.

4. If approved for a loan with no credit, receive your funds

If the lender approves you for a loan with no credit, you can expect to get the funds quickly. Many lenders will deposit the money into your account that same day, within 24 hours, or in a few days.

Which loan with no credit history is right for me?

The right loan with no credit history may depend on your financial situation and needs. For instance, if you just need a few hundred dollars to tide you over until your next payday, a payday loan may be the right option for you. But if you need a larger sum of money to cover an unexpected car repair or medical bill, you may want to consider an installment loan.

Where can I get loans with no credit history?

You can get a loan for no credit from Advance America. We offer payday loans, installment loans, title loans, and lines of credit that you can apply for without needing credit. Advance America is a safe and reputable lender, with an A+ Better Business Bureau rating and countless positive reviews on Trustpilot and Google.

Get an Advance America loan with no credit

Even if you don’t have an established credit history, you may still get approved for an Advance America loan. Advance America will consider factors in addition to your credit score like your income and current debt when deciding whether to approve you.

We offer a variety of products including payday loans, installment loans, title loans, and lines of credit. You may apply online or in-store and receive your funds in as little as 24 hours. Visit Advance America today to learn more about the loans we offer.