Online Loans for Bad Credit

You can still get approved for an online loan if you have a bad credit score. In fact, there are many online loans for people with poor credit that can help you get the money you need. Many of these bad-credit online loan options come with fast applications and quick funding. Here’s a closer look at how online loans for bad credit work, their benefits and how to get an online loan with bad credit so you can get funds fast to cover expenses.

What is an online loan for bad credit?

A bad-credit online loan is a loan for borrowers with any credit score and credit history. If you apply for this type of online loan, you can expect the lender to look at factors other than your credit. Your income, employment status, and current debts are some examples of factors that will help them decide whether to approve you if you have poor or bad credit.

Is it easy to get online loans for bad credit?

Borrowers can easily get online loans for bad credit. These loans often come with quick applications that you can complete in just a few minutes in store or online from the comfort of home. After you apply for an online loan, many lenders have a quick or instant approval process. This means you may be able to get approved and receive the funds in your bank account as soon as the same day you apply or within 24 hours.

Types of online loans for people with bad credit

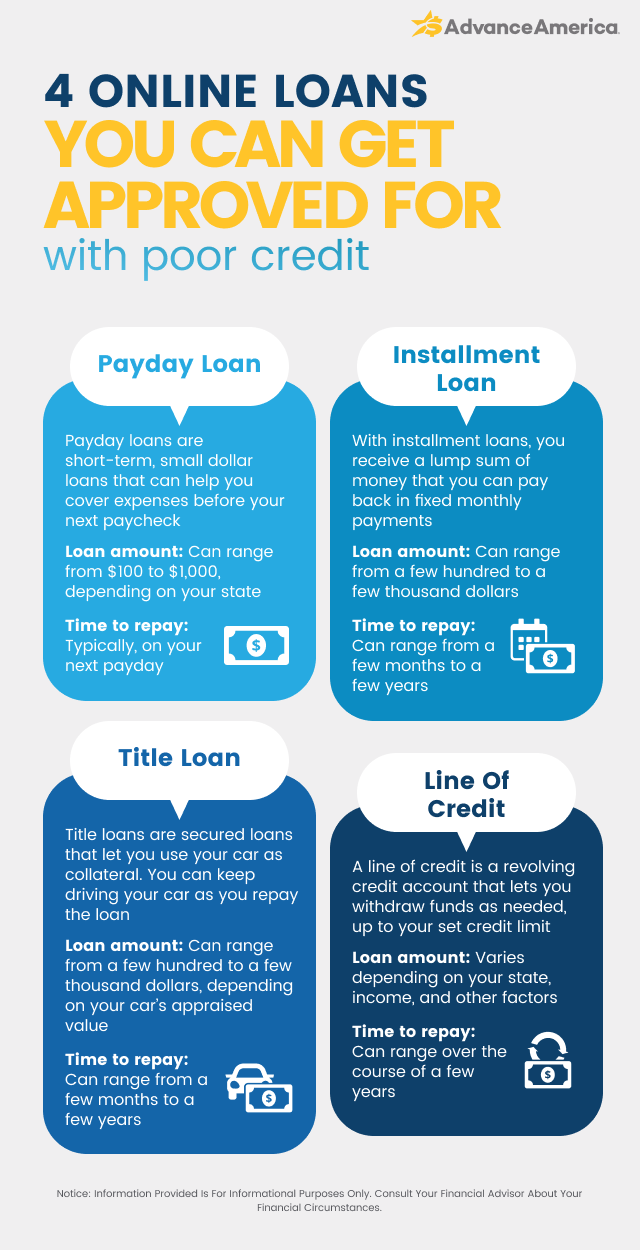

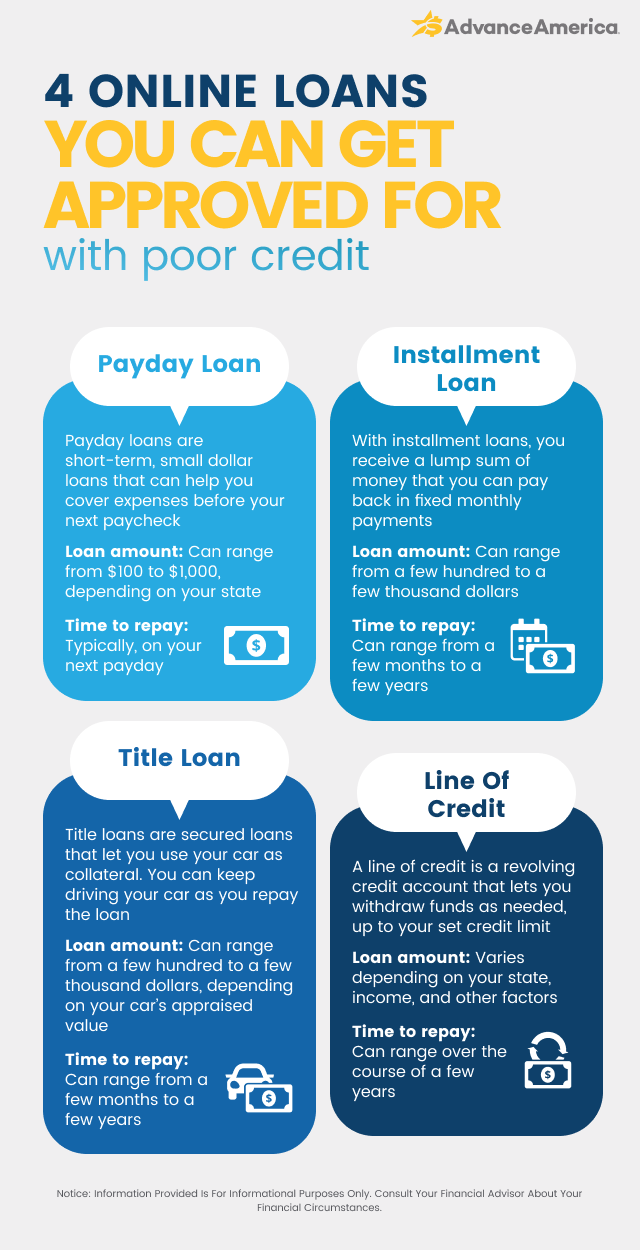

There are a variety of online loans for people with bad credit, including:

Payday loans

A payday loan is a short-term, small dollar loan that can help you cover expenses before your next payday. Poor credit borrowers can repay this bad-credit online loan once they get their paycheck, usually within two to four weeks.

Installment loans

An installment loan for borrowers with bad credit allows you to borrow a set amount of money at once. You can then pay this online loan back over time via fixed monthly payments, or installments.

Title loans

A title loan for people with poor credit is a secured loan that uses your car as collateral. If you own your car, you can exchange your title for a lump sum of cash. You can keep driving your car as you repay this bad-credit loan.

Lines of credit

A line of credit for bad-credit borrowers is similar to a credit card. You can withdraw as much or as little as you’d like up to your set credit limit, and you’ll only pay interest on the amount you borrow.

Credit card cash advances

A cash advance is a small, short-term loan that you can receive from your credit card issuer. If you get approved for this type of bad-credit online loan, you may receive the funds that same day, within 24 hours, or in a few business days.

Where can I get an online loan for bad credit?

You can get an online loan for bad credit from online lenders like Advance America. We offer payday loans, installment loans, title loans, and lines of credit that can get you fast funds. Advance America approves borrowers with all types of credit scores and we’ll consider factors in addition to your credit score, like income and employment history, when making our approval decision. This means you don’t need good credit to get approved for one of our online loans.

Benefits of online loans for people with bad credit

Here are some advantages of getting an online loan with poor or bad credit:

Easy application

Online loans for bad credit come with easy applications that you may be able to complete in just a few minutes, from the comfort of home. Make sure you have all personal and financial information and documents ready, including a government issued ID, proof of income, and your bank account number.

Quick funding

Once you submit an online loan application for a bad-credit loan, you may get an instant or quick approval decision. If approved, you may receive the funds from the online loan in your bank account as soon as the same day you apply or within 24 hours.

Good credit not needed

You don’t need good credit to get approved for an online loan. Many lenders will consider factors in addition to your credit score when deciding to approve you, like income, employment history, and current debts. This means that borrowers with poor or fair credit can still get approved.

Do online loans for bad credit affect your credit score?

Online loans for bad credit can affect your credit score in a few ways. Applying for a loan may cause the lender to do a hard inquiry, which can lower your score by a few points. Luckily, this negative impact is only temporary, and will diminish over time as you make on-time loan payments. Paying back the online loan consistently and avoiding late payments can improve your credit score and help you qualify for loans with better rates and terms in the future.

How to get an online loan with bad credit

If you’re interested in online loans for bad credit, follow these steps:

1. Check your credit report for errors

Go to AnnualCreditReport.com to pull copies of your credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion. If you notice any errors, dispute them right away.

2. Compare bad-credit online loans

Do some research and find several lenders that offer online loans for people with bad credit. Then, compare all of your options and choose the best online loan for your budget, lifestyle, and unique needs.

3. Gather all necessary documents

Before applying for an online loan for bad credit, make sure you have a government-issued ID like a driver’s license or passport on hand. You may also need proof of an active checking account and a paystub or another document that shows your income.

4. Fill out and submit your online loan application

Go to the lender’s website and fill out an online application for a poor-credit loan. Before you submit the application, double check your information for accuracy.

5. Wait for approval

After you submit an application for an online loan for bad credit, wait for the lender to get back to you with a decision. Many lenders will approve you instantly, the same day you apply, or within 24 hours.

6. Receive your funds

If you chose direct deposit, the money should hit your bank account shortly after you get approved for the bad-credit online loan. You may also receive the funds via check or prepaid card, depending on the lender.

How to compare online loans for bad credit

To compare online loans for people with bad credit, consider the following factors:

- Bad-credit loan type: Decide whether you want a secured or unsecured online loan for people with bad credit. If you’re willing to provide collateral and want a larger loan amount, a poor-credit secured loan may be right for you. But if you don’t want to risk losing an item of value you own as collateral, you should consider getting an unsecured loan for people with bad credit.

- Loan amount: Consider how much money you need when deciding which bad-credit online loan to apply for. Payday loans typically offer a few hundred dollars to tide you over until your next payday. Installment loans and title loans for borrowers with bad credit, on the other hand, can offer larger loan amounts.

- Repayment terms: Some online loans for people with bad credit have to be repaid in a lump sum, while others have repayment terms that can last a few months or years. Decide whether you want to pay back a bad-credit online loan all at once or over time.

Which bad-credit online loan is right for me?

To choose the right online loan for borrowers with bad credit, consider your financial situation and needs. If you just need a few hundred dollars to cover essential expenses before your next payday, for instance, then a payday loan may make the most sense. And if you need a larger sum of money to cover a home improvement project or medical bill, you may want to consider an installment loan. Figure out how much money you’ll need and make sure you have a good repayment plan in place before applying for an online loan for bad credit.

You could get approved for an Advance America online loan with poor credit

If you have poor or bad credit, you may still get approved for an Advance America loan. We offer a variety of online products including payday loans, installment loans, title loans, and lines of credit. You can fill out an easy application online or in-store and get approved quickly. Upon approval, you may receive your funds in as little as 24 hours. Visit Advance America today to learn more about the loans we offer for people with bad credit.