How to Get an Unsecured Line of Credit

An unsecured line of credit offers a flexible way to borrow money. It doesn’t require you to take out one lump-sum payment. Instead, it works like a credit card and allows you to withdraw funds as you need to up to a certain credit limit. You’ll only pay interest on the amount you borrow.

You can get an unsecured personal line of credit online from Advance America. Here’s a closer look at line of credit loans online.

What is an unsecured line of credit?

An unsecured line of credit is a revolving credit account that lets you withdraw funds whenever you need, up to your set credit limit. You’ll only pay interest on the money you take out, and you can pay back your loan all at once or over time. With unsecured lines of credit, you don’t need to provide an asset, like your car or house, as collateral.

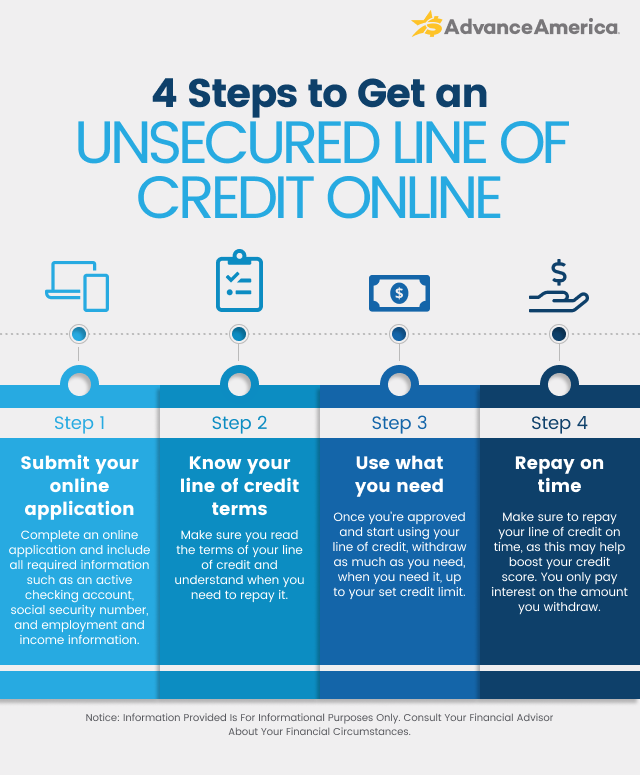

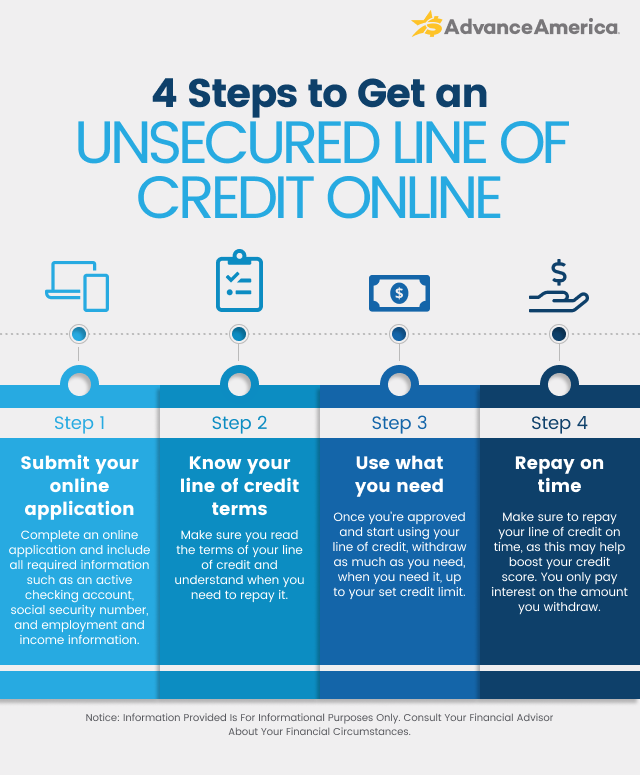

How to get an unsecured line of credit online

1. Understand Your Credit and Income Qualifications

Lenders who provide online lines of credit need to understand your ability to repay them. Once they do, they’ll be able to establish your maximum borrowing limit.

An unsecured line of credit loan with Advance America can go up to $2,500, based on the state you live in. Visit our line of credit page to see if you’re eligible and what your maximum borrowing amount will be.

2. Review Unsecured Line of Credit Providers

Since there are several lenders who offer lines of credit online, do your research and ensure the one you choose is trustworthy. Review trust ratings on a site like TrustPilot and read what real customers have to say about prospective lenders. Opt for a lender with a high rating and many positive reviews.

Advance America’s lengthy experience offering lines of credit to its customers is paired with an A+ rating by the Better Business Bureau and 5-star TrustPilot reviews to ensure safety and security.

3. Submit Your Online Line of Credit Application

Before you fill out and submit an online line of credit application with a trustworthy lender like Advance America, be prepared to provide the following information to ensure fast funding:

-

Active checking account (you’ll need your bank’s ABA and routing numbers)

-

Social Security Number

-

Employment and income information. In some cases, you may be asked to provide proof of income, like a recent pay stub.

4. Know Your Line of Credit Terms

Carefully read the terms of your unsecured line of credit. Make sure you understand when you’ll be able to withdraw money and when it’ll be time to repay it. Also, note that interest charges will only be applied to the amount you withdraw. If you’re unclear about any information outlined in your terms, contact the lender for clarification.

5. Use What You Need

With an unsecured personal line of credit, you can borrow as much or as little money as you’d like up to your credit limit. This flexibility is great as it can allow you to match your need fluctuating expenses. Remember to only use what you need so that you don’t end up overpaying for your loan.

6. Repay on Time

When it comes time to repay your unsecured loan line of credit, do so on time. Timely repayments can help boost your credit score. With a higher credit score, you’ll be able to secure lower interest rates and more favorable terms on other loan products in the future.

Benefits of an unsecured line of credit

Compared to a traditional loan that requires you to take out a lump sum of money upfront, an unsecured line of credit is flexible. It’s a particularly great option if you’re unsure of how much money you’ll need but want an option to cover monthly or sudden expenses that go a bit beyond your paycheck.

With a line of credit, you’ll have the freedom to withdraw cash whenever you need or want to. Best of all, you won’t have to pay interest on any money you don’t borrow.

Get an Advance America unsecured line of credit today

Advance America offers personal lines of credit that can give you easy access to funds whenever you need to cover expenses. You can apply in minutes from the comfort of your home or at an Advance America store location, and you may receive your funds the same day you apply. Best of all, you don’t need good credit to get approved for our unsecured lines of credit.