Emergency Loans for Bad Credit

An emergency loan can help you cover the cost of a car repair, medical bill, or any other unexpected expense. And luckily, you don’t need excellent or great credit to take out this type of loan. There are many emergency loans that you can get approved for with a poor or fair credit score. Let’s take a closer look at how emergency loans work, the types of loans available, and how to get one.

How do emergency loans for bad credit work?

Emergency loans for bad credit help borrowers that don’t have a great credit score pay for financial emergencies. If you get approved for this type of loan, you can receive the money you need quickly and take care of your expenses right away. Emergency loans for bad credit are great solutions if you don’t have the cash on hand to cover a financial curveball.

Types of emergency loans for borrowers with poor credit

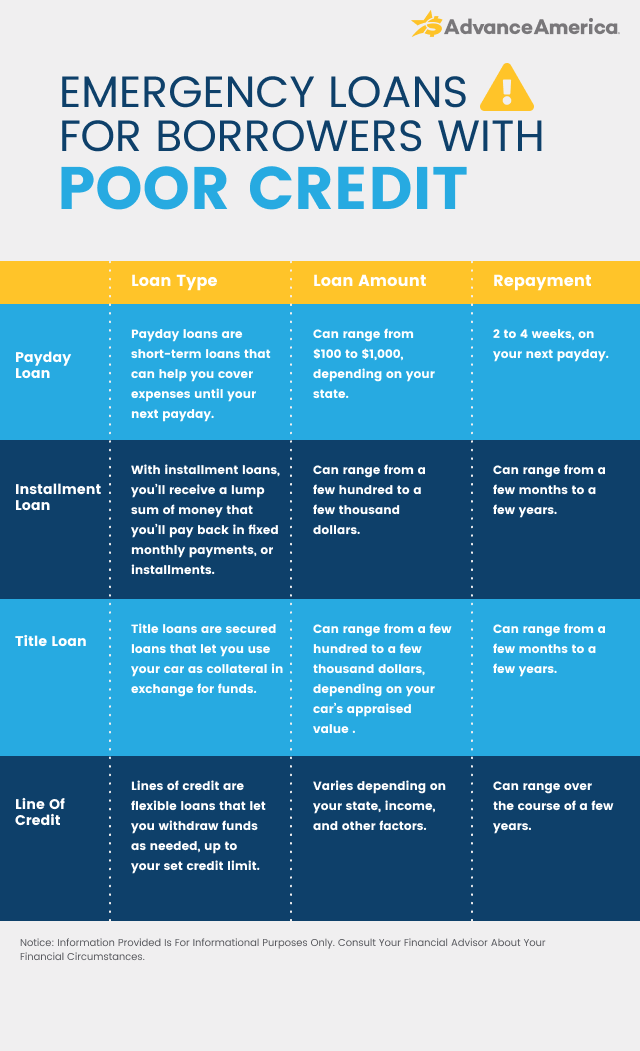

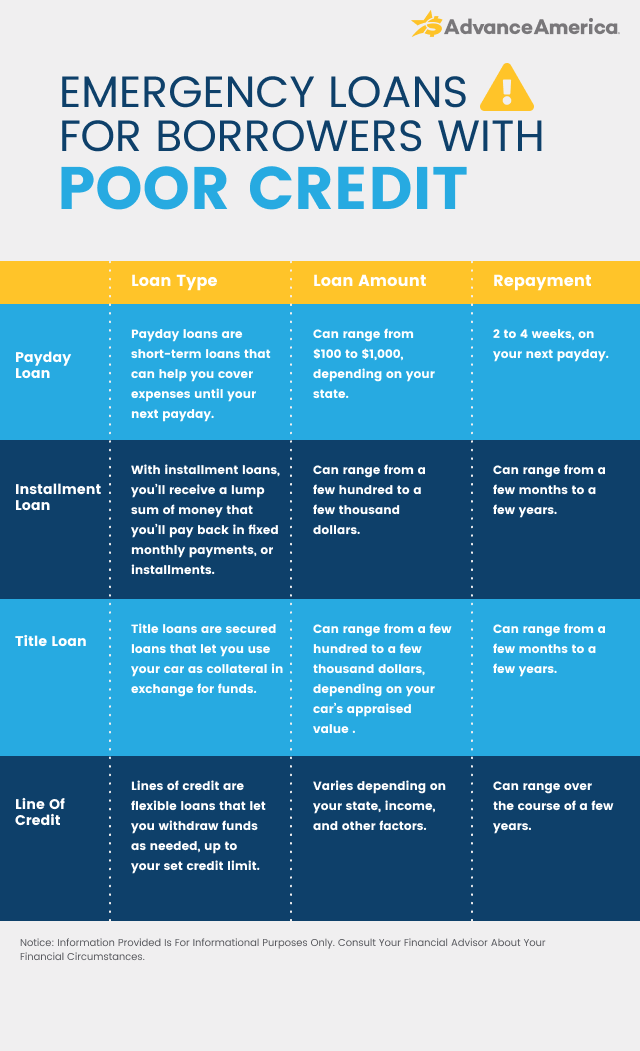

There are different types of emergency loans for borrowers with poor credit, including:

Payday loans

Payday loans are short-term, small dollar loans that can help you cover expenses until your next payday. You’ll pay them back in full the next time you receive your paycheck, typically within two to four weeks.

Installment loans

Installment loans allow you to borrow a lump sum of money upfront. You can repay these loans over fixed monthly payments or installments. Repayment terms for installment loans can be anywhere from a few months to several years.

Title loans

Title loans are secured loans that offer fast cash in exchange for your car title. The amount you may borrow will be based on your car’s appraised value. You can continue to drive your vehicle while you pay your loan back.

Lines of credit

Lines of credit work a lot like credit cards. You can borrow as much or as little money as you’d like up to a set credit limit, which lenders may determine based on your credit score and income. You’ll only pay interest on the amount of cash you take out.

How to get a bad-credit emergency loan

Here’s how you can get an emergency loan for bad credit:

1. Compare lenders

If you’re wondering where to get an emergency loan if you have poor credit, you’ll be pleased to learn that many lenders offer them. Do some research and compare all of the options available to you.

2. Choose the right loan option

When comparing loan options, consider factors like the loan amount, interest rate, repayment terms, and fees. Then, select the right loan for your unique situation and budget.

3. Gather necessary documents

Before you apply for an emergency loan for bad credit, you’ll need to collect some documents. These may include a government ID like your driver’s license, and proof of income such as your pay stubs.

4. Fill out and submit your application

Depending on the lender you choose, you may be able to complete your application online from home. Fill it out carefully and make sure to include all information needed.

5. Receive your funds

Upon approval, the lender will distribute your funds. You may get them via direct deposit, check, cash, or a prepaid card.

Get an emergency loan from Advance America

Advance America offers different types of emergency loans including payday loans, installment loans, title loans, and lines of credit. You don’t need good credit to get approved and can fill out an application online from the comfort of your home. Upon approval, you’ll receive the funds quickly, sometimes the same day you apply or within 24 hours. Visit Advance America today to learn more about the loans we offer.