Bounced Check

If you write a check but there are not enough funds in your account to cover it, the check will bounce. While this can leave you feeling embarrassed, it may also result in fees and possible negative effects on your credit score, and several other issues. To avoid this scenario, don’t write a check unless you’re positive you have the money in your account to pay for it.

Read on to learn how to avoid bounced checks and what to do if your check bounces.

What is a bounced check?

A bounced check is a check that can't be processed because there aren't enough funds in your account to cover the payment. When a check bounces, it will be returned unpaid to your bank, and you'll likely face fees.

What does it mean if a check bounces?

If a check bounces, it means that there was not enough money in your bank account to fund the check. The person attempting to cash the check won’t receive their funds and may even have to deal with additional fees.

What happens when a check bounces?

Now that you know what a bounced check is, here’s an overview of the consequences you may face if your check bounces.

The Payment Doesn’t Go Through

When you bounce a check, the individual or company you wrote the check to will not receive the money you intended to give them. Your payment will get rejected and the check recipient may or may not reach out to let you know.

You Could Face Fees

If your check bounces, you may be charged a returned check fee. This fee will be charged by the recipient of the check as a penalty for trying to distribute money that you don’t have. You might also owe a non-sufficient funds or NSF fee to your bank, which can run you anywhere between $20 to $40 or a percentage of the check amount.

Your Credit Score May Be Impacted

Your credit score may take a hit if you bounce a check and don’t take care of the issue in about 30 days. This is because an unpaid check can make its way to collections and onto your credit report. In addition, if the check is for your mortgage, car loan, or another bill, the lender may report your late debt payment to the credit bureaus.

Your Account May Be Reported

If you bounce checks often, your bank may report your account to a consumer reporting agency, which tracks your deposit history. In the event that this happens, you may have trouble opening bank accounts at other banking institutions.

What fees will you have to pay if you bounce a check?

If your check bounces, there are a number of bounced check fees you may have to pay. One of the first things that may happen is your bank might charge you with overdraft fees or nonsufficient funds (NSF) fees. You may then have to pay a fee to the recipient if they get charged for depositing a bad check. Depending on the state you're in and who you sent the bounced check to, you may also have to pay merchant fees.

How can you tell if your check bounced?

If you are wondering if a check you wrote has bounced, keep an eye on your bank statement for new fees. These might be called “return” fees or “NSF” fees.

You can also directly reach out to your bank or the person you wrote the check to in order to find out the status of your check. If you contact the payee before they attempt to cash your check, they may be willing to work with you on an alternate payment method instead of trying to deposit the check.

Will you be notified by your bank if your check bounces?

Banks aren’t required to notify you if your check bounces due to insufficient funds. If you’re worried that a check you wrote might bounce, keep actively checking your bank account for unusual fees.

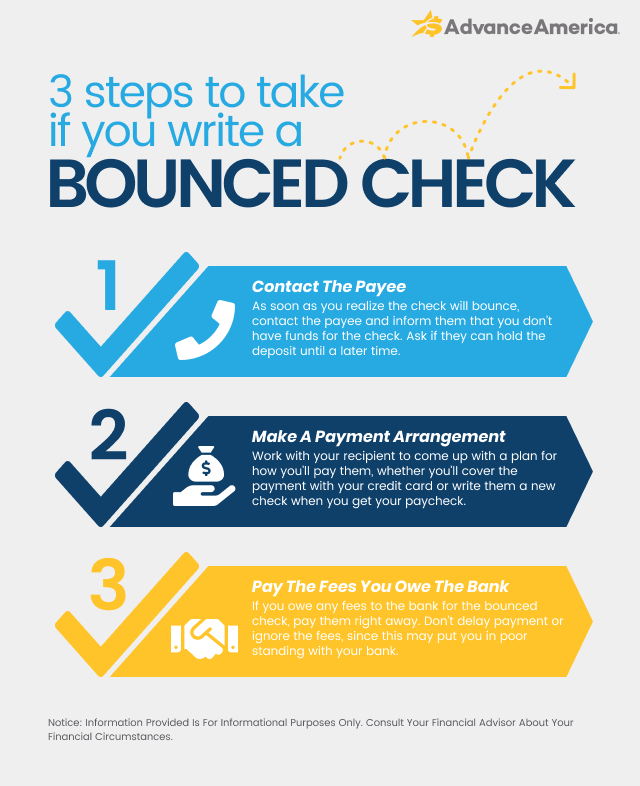

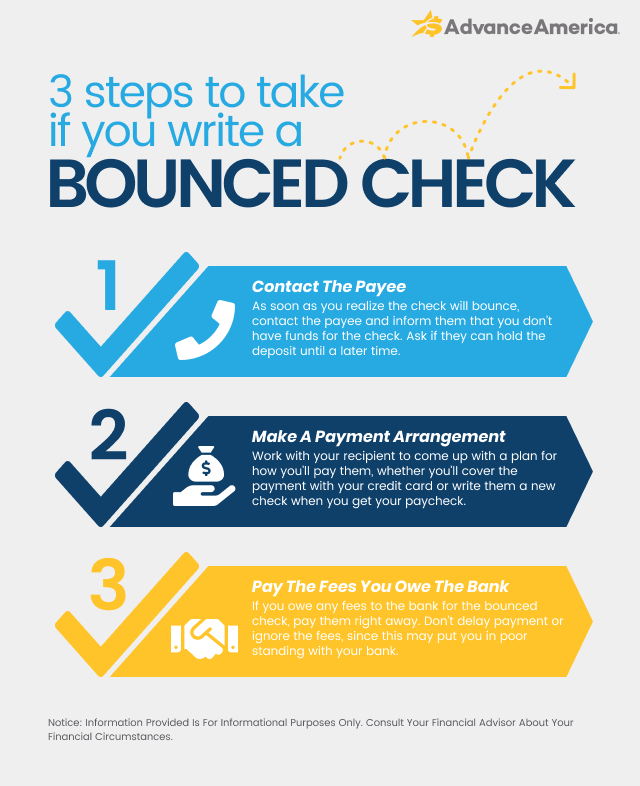

What to do if you bounce a check

If you write a bounced check, follow these steps to protect yourself and your finances.

Contact the Payee

Get ahold of the payee and inform them that you don’t have funds for the check, as being proactive will benefit you in the long run. If they haven't cashed the check yet, ask if they can hold the deposit until a later time.

Make a Payment Arrangement with the Recipient

Work with the recipient to come up with a plan on how you’ll pay them. Maybe you’ll cover the payment via credit card, or perhaps you’ll write a new check in two weeks when you get your paycheck and will have enough funds in your account.

Pay the Fees You Owe the Bank

If your bank charges you fees for your bounced check, pay them and move on. Don’t delay payment or ignore the fact that you owe these fees. Doing so can put you in poor standing and damage your relationship with your bank.

How to avoid bouncing your next check

Now that you know what to do when you bounce a check, here are some great ways to avoid a bounced check:

Keep Track of Your Account Balance

Check your account balance on a daily or weekly basis. This way you’ll know how much money you have in your account at all times. You can also sign up for alerts and get notified every time your balance dips below a certain threshold.

Get Overdraft Protection

If you enroll in overdraft protection through your bank, your checks will go through, even if you don’t have sufficient funds in your account. But if you choose this option, be aware that you’ll probably be responsible for overdraft fees, which can be expensive.

Only Write a Check if You Can Cover the Payment

Before you write a check, stop and think about whether you can cover the payment. If you’re unsure, check your account balance online or via phone or mobile app. It's also important to factor in any other checks you may have written recently that haven't bee cashed yet. Don’t write a check unless you’re positive you have enough funds to pay for it.

Save Extra Money in Your Account

It’s a good idea to leave some extra money in your account. Even an extra $50 to $100 can save you from writing a bounced check and all of the consequences that come with it.

Pay with a Debit Card

If you’re unsure of whether you have enough money to cover a check, try to pay with a debit card. As long as you haven’t signed up for overdraft protection, your card will automatically get rejected if you don’t have enough funds.

How to avoid bouncing your next check

Sometimes, you need money to pay a check right away. If you come across this situation, consider a loan to keep your check from bouncing. Advance America offers online loans, such as payday loans and installment loans that can get you cash quickly, even if you don’t have great credit.

What happens if you cash a bounced check?

Cashing a bounced check can have different penalties depending on if you were aware the check would bounce. If you know that a check will bounce and cash it anyway, that can be considered fraud and can be punishable by law.

On the other hand, if you had no reason to suspect a check would bounce before you cashed it, you may still have to face a fee from your bank. This might be called a “deposit item returned” fee.

How can you avoid getting a bounced check?

If you are concerned that you may receive a check that may bounce and want to avoid being penalized for cashing a bounced check, here are a few simple steps to protect yourself:

- Look for alternative forms of payment: Receiving money through a digital transfer such as Venmo or Zelle, a certified check or money order, or via old fashioned cash are all safer forms of payment than a personal check

- Double check the person’s ID: Confirming that the person who signed the check and the person giving you the check are one and the same can help avoid the problem of stolen checks

- Wait to spend the cashed check: If you wait to spend the funds until the check clears, you may be more likely to avoid any fees from a bounced check